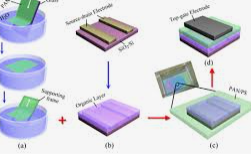

Promotion and Challenges of Chip Particle Technology

At the forefront of semiconductor innovation, chiplet technology emerges. It's a bridge for heterogeneous integration - connecting system companies with semiconductor suppliers. Chip particles, crafted in diverse foundries, are pivotal. They drive technological advancement, propelling China towards a significant leap in domestic AI processor development. These processors could rival those from Western companies, currently entangled in export restrictions.

However, innovation's path is not free from hurdles. Stringent export controls cast a shadow. The U.S. Department of Commerce’s Bureau of Industry and Security, under the Export Administration Regulations (EAR), has spoken. They've outlined new measures. Advanced computing and semiconductor manufacturing equipment are under scrutiny. Chip particle technology, while not overtly highlighted in official documents or technology media, silently bears potential industry-altering consequences.

A Glimpse into New U.S. Export Control Regulations

November 17, 2023, marks a shift. New regulations will take effect. They pinpoint chip particles, echoing U.S. fears over China's potential to exploit technical loopholes for AI processor advancement. This unfolds as the U.S. restricts China's access to EUV lithography for fine-node chips. In parallel, American giants like Nvidia face prohibitions on exporting high-end AI processors to China.

The U.S. export control agency's strategy is multifaceted. It involves dissecting high-end processors and limiting access to advanced manufacturing tools. The goal? Safeguard national security and intellectual property. Yet, ironically, these actions intensify US-China trade tensions.

Analyzing Export Restrictions

The U.S. government's new playbook imposes fresh demands on semiconductor manufacturers. It's intricate. If a chip design incorporates multiple chip particles, the rules tighten. Wafer foundries must now calculate the total transistors in any manufactured chip die, sidestepping those made by others.

For chips with high integration, the U.S. sets a bar: over 50 billion transistors. Furthermore, regulations extend to integrated circuits, computers, and components with over 50 billion transistors and high-bandwidth memory (HBM). They might necessitate re-export or export licenses under the EAR.

Transistor counting becomes an art. Fabs can opt for two methods. Either multiply the transistor density by the chip area or use design verification tools to estimate based on the GDS file. This nuanced approach underscores the U.S. government’s relentless focus on technology and security.

In Conclusion

Chip particle technology, a driver in the semiconductor sphere, now stands at the crossroads of international policy and technological rivalry. The U.S.'s new controls aim to preserve technological supremacy and national security. But, they also stir deep reflections on global scientific innovation and cooperation. This interplay of technology and policy will undeniably shape the semiconductor industry's future.